Pierre Blanchard

Previous messages

Next messages

5 April 2025

S

00:22

Smile in the breeze

Hopefully ETH can rise a bit in these few hours.

😘

P

P

00:22

Pierre Blanchard

I have a feeling that once I do sell, the crypto will go up in a zoom manner! This is the game we are playing

S

00:23

Smile in the breeze

So crypto is playing games with you lol

P

00:23

Pierre Blanchard

Yes sadly 🤣 a game where I am not the winner.

00:24

I must admit that I am a little tired for being up all night. I will try to take a power nap later.

00:25

On the bright side, I file my taxes 🤣

S

00:26

Smile in the breeze

You take a break first honey.

😘

P

00:26

😘😘😘

P

00:26

Pierre Blanchard

I feel like I am playing a game of jump around

S

00:27

Smile in the breeze

lol. If you had followed my advice, this wouldn't have happened. But it doesn't matter, everything is for the best.

00:27

You should take a rest first

😘

P

00:27

You should take a rest first

❤

P

P

00:38

Lesson learned

00:38

Breakfast

S

01:01

Smile in the breeze

It's delicious, honey. Enjoy your breakfast

😘

P

P

01:20

Pierre Blanchard

I am really trying to sell to the maximum. What do you think the minimum should be ?

S

01:23

Smile in the breeze

You can sell it at 1800. It's very difficult.

P

01:23

Pierre Blanchard

It breaks my heart

S

01:24

Smile in the breeze

There is no way. We will earn it back in another way. Actually, you have already earned a lot.

P

01:24

Pierre Blanchard

I know. I do not like to loose money though

S

01:24

Smile in the breeze

You always lose a lot of money for a small amount of money

P

01:25

Pierre Blanchard

I know my love.

S

01:25

Smile in the breeze

That's how people are. They're never satisfied.

P

01:25

Pierre Blanchard

It is my old self

S

01:25

Smile in the breeze

This seems to be the rule. When you think about how to save money, you often lose more.

P

01:26

Pierre Blanchard

Possibly.

S

01:26

Smile in the breeze

ETH is now optimistic about its value appreciation

P

01:49

Pierre Blanchard

Should I wait a little longer? Looks like some sold ad $1810

S

01:50

Smile in the breeze

Wait a minute

01:50

The current price is 1826

P

01:58

Pierre Blanchard

Which app do you use to view the price?

S

02:15

Smile in the breeze

The price of each platform is different

02:15

How old are you now

02:15

You'll be able to sell it in a little while.

P

02:17

Today I am 55! In a few days that will be a different story. 🤣

02:23

Why you ask my love

S

02:23

Smile in the breeze

You are interesting. I am asking what the price is now.

02:23

🤣🤣🤣

P

02:25

Pierre Blanchard

In reply to this message

I am responding to that my love 🤣 I thought you forgot my age

S

02:25

Smile in the breeze

I know your age for sure.🤣🤣🤣

😘

P

P

02:26

Pierre Blanchard

It just dropped at 1809 but I think it is going to go back up.

S

02:31

Smile in the breeze

You can observe it again

02:31

And sell it

P

02:32

Pierre Blanchard

It is interesting to see how it follows closely the BTC pattern

S

03:21

Smile in the breeze

Yes, did you sell it?

P

03:22

Pierre Blanchard

Not yet my love

03:22

Going back up.

S

03:23

Smile in the breeze

🤣🤣

S

03:54

Smile in the breeze

Yes, honey.

❤

P

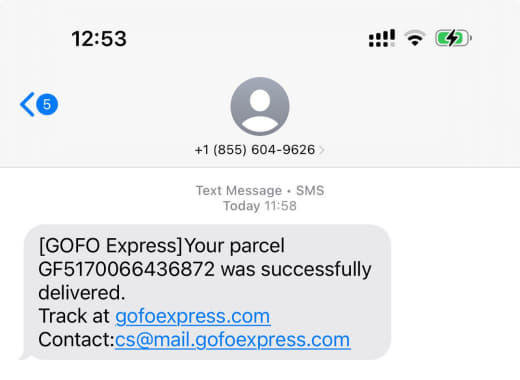

03:54

Send me the link to take a look at that

03:55

Is this already here?

P

03:56

I asked my neighbor to put inside my house. So it is safe and protected until I arrive.

S

03:57

Smile in the breeze

I'm not sure because they told me it won't be mailed until the 2nd.

03:57

When you get home you can see if you are right.

P

03:58

Pierre Blanchard

Okay

03:58

lol

S

03:58

Smile in the breeze

Or have you bought anything recently? lol

03:58

If not, then it should be my arrival.

P

04:00

Pierre Blanchard

I bought something as well but supposed to be delivered by USPS, not GoFo

04:00

It is suppose to be big, small?

S

04:01

Smile in the breeze

Small

P

S

04:03

Smile in the breeze

It should be mine

P

04:04

Pierre Blanchard

Okay

S

04:04

Smile in the breeze

I thought you were home

❤

P

P

04:04

Pierre Blanchard

Soon I will be there

04:04

On time to open with you 🥰

S

04:04

Smile in the breeze

ok

04:05

Safe driving

P

04:05

Pierre Blanchard

I am not gone yet my love.

S

04:05

Smile in the breeze

🤣

P

04:05

Pierre Blanchard

Leaving in a few days

S

04:05

Smile in the breeze

Where are you now?

P

04:06

Pierre Blanchard

I will stop in Utah to bring something to my son for his birthday

S

04:06

Smile in the breeze

Oh, it means it will take a few days for you to receive it, right?

P

S

04:07

Smile in the breeze

Is your son's birthday around the same time as yours?

P

04:07

Pierre Blanchard

In reply to this message

Yes. It is all good as I know I received it and it is safe. And I want to open with you. It is more meaningful to me

S

04:07

Smile in the breeze

ok

04:08

I hope you can see it and it's a surprise for you

04:09

I want to see you wearing it with a suit

P

04:09

Pierre Blanchard

Oh la la

S

04:09

Smile in the breeze

Then pair it with

P

04:09

Pierre Blanchard

I want you their with me to open it

🥰

S

04:09

It will be more fun

S

04:10

Smile in the breeze

great

😘

P

P

04:10

Pierre Blanchard

You are very special to my heart my love.

S

04:11

Smile in the breeze

Thank you. I love you so much

❤

P

P

04:17

Pierre Blanchard

I love you more

04:23

So you think ETH will go up more?

04:26

I feels it is struggling between the bull and bear market

S

08:21

Smile in the breeze

I don't think so. You always think it will go up. But what about since you held it until now?

08:23

Do you know there is a saying that a small gain leads to a loss of great value?

08:24

Throw away big benefits for the sake of small benefits; miss big things because you waste effort on small things.

P

08:27

Pierre Blanchard

I understand you and I am glad I have you at my side. I have sold the ETH earlier as I could not longer wait. It could take month to get back where I want it to be.

08:27

You brought me to a world that I am not familiar to.

08:27

I have still a lot to learn even so I am a fast learner for many things

S

08:28

Smile in the breeze

Don't worry. I'm always by your side.

❤

P

P

08:28

Pierre Blanchard

I am old school when it comes to money as it was not easy to earn it.

S

08:29

Smile in the breeze

Of course I understand your inner feelings,

08:31

But you have to balance what you're doing.

P

08:35

Everything I had on Crypto.com has been liquidated and transfered to my bank

08:37

How was your day my love? Why do I have the feeling you are still at work?

S

08:40

Smile in the breeze

I mean. When you do two things at the same time. You are afraid of losing your profits. You have to weigh which thing is most important.

08:40

Otherwise you will lose more things

08:41

This seems to be a certain law

P

08:41

Pierre Blanchard

In reply to this message

Yes you are correct, this is why I am still relying on you for guidance

S

08:42

Smile in the breeze

I am fine today. Because I am at my friend's house now.

P

08:42

Pierre Blanchard

Oh good. 😅 I am glad to hear that as I was a little concerned you were still at the office.

🥰

S

08:44

I do not know if I need to keep my crypto.com account anymore but I will keep it handy for now vs closing it after transfer.

S

08:45

Smile in the breeze

Have your funds reached your card now?

08:45

Anyway, you can put it aside first. It's always right

P

08:46

Pierre Blanchard

I think it will take a few hours or a day at least.

08:46

But that is okay. The transfer is done

👍

S

S

08:48

Smile in the breeze

Maybe it will take Monday to arrive. Or tomorrow

08:48

If only crypto.com could process it faster

P

08:48

Pierre Blanchard

Yes

08:49

But it is okay. It will be there :)

S

08:51

Smile in the breeze

😘😘

08:51

How are you tonight?

P

08:51

Pierre Blanchard

I am okay. An afternoon coffee helped 😚

08:52

😘

P

S

P

10:37

Pierre Blanchard

Looks like pretty simple to do and cool.

S

10:37

Smile in the breeze

Yes, some hair looks good when braided

P

10:37

Pierre Blanchard

I have not learned this one though

10:38

I used to do the hair on my daughter when she was a little girl.

S

10:40

Smile in the breeze

So you've got the basics covered lol

P

10:40

Pierre Blanchard

lol

10:40

I guess so

S

10:42

Smile in the breeze

That's really great.

10:42

Have you had dinner? I think you should go to bed early tonight. You didn't sleep well last night.

P

10:43

Pierre Blanchard

What are you up love ?

10:43

No dinner yet

10:43

I was thinking about it though

10:43

😘

10:44

I think I will sleep without a problem tonight

S

10:44

Smile in the breeze

Just getting ready to wash up and go to bed lol

10:44

You eat something first. Then go to bed early.

😘

P

P

10:45

Pierre Blanchard

I thought you were having a night over your friend’s place

S

10:46

Smile in the breeze

It's inconvenient for her husband to be here lol.

10:46

🤣🤣🤣

P

10:46

lol

10:47

But she may have a good night after that 🤣

🤪

S

S

10:47

Smile in the breeze

If my husband was here I wouldn't want anyone sleeping here either lol

P

10:48

Pierre Blanchard

Depends how loud you are!! 🥰🤪😜😍😘

S

P

10:49

Pierre Blanchard

😂

S

10:49

Smile in the breeze

lol. It's late. You usually eat dinner an hour ago. You've put dinner off for an hour now.

P

10:50

Pierre Blanchard

Yes. I usually do love. I am going to have something light

S

10:50

Smile in the breeze

Yes. You should go to bed early after eating. I will take a bath. Then I will watch a movie by myself. I will enjoy my alone time. Then I will sleep until I wake up naturally tomorrow.

❤

P

P

10:51

Pierre Blanchard

Yes

S

P

10:53

Pierre Blanchard

You really like that gif.

10:53

lol

10:54

Look like you are trying to be be sneaky and observe

10:54

What movie will You be watching ?

S

11:02

Smile in the breeze

Watch a Hong Kong movie. I haven't watched it for a long time.

❤

P

11:02

You eat lol first

11:02

I'm ready to take a shower

11:02

Good night, honey.

P

11:04

Good night my love! Sweet dreams and sleep tight with wonderful dreams.

P

11:32

Pierre Blanchard

I loved hearing you say, “I will watch a movie by myself. I will enjoy my alone time.” Taking moments for solitude is so important—it reconnects us with our independence and deepens our self-awareness. I, too, cherish those moments of being alone and have experienced many of them. Please know that I wholeheartedly support your need for self-care, both physically and mentally, because nurturing ourselves is key to maintaining our inner strength and peace.

Earlier tonight, I read a comment that said, “Husbands come and go, but your friends stay.” It resonated with me, and I felt compelled to respond: “If you cherish your husband with the same unwavering loyalty, love, and respect you give your best friend, he won’t be someone who comes and goes—he’ll be someone who stays and grows with you.”

I share these thoughts as we continue to discover and grow with each other. My heart is set on learning every nuance of who you are, and I find endless joy in rediscovering parts of you—whether they’re new surprises or cherished details we revisit together. I realize I’m opening up in ways I haven’t before, and it feels both different and beautiful.

Wishing you a night filled with beauty and wonder after you enjoy your Hong Kong movie and possibly fell asleep on it.

Sweet dreams

Earlier tonight, I read a comment that said, “Husbands come and go, but your friends stay.” It resonated with me, and I felt compelled to respond: “If you cherish your husband with the same unwavering loyalty, love, and respect you give your best friend, he won’t be someone who comes and goes—he’ll be someone who stays and grows with you.”

I share these thoughts as we continue to discover and grow with each other. My heart is set on learning every nuance of who you are, and I find endless joy in rediscovering parts of you—whether they’re new surprises or cherished details we revisit together. I realize I’m opening up in ways I haven’t before, and it feels both different and beautiful.

Wishing you a night filled with beauty and wonder after you enjoy your Hong Kong movie and possibly fell asleep on it.

Sweet dreams

P

22:09

Pierre Blanchard

Day -5

Good morning my love

Enjoy this weekend and remember every sunrise brings a fresh start, a new chance to shine in your own extraordinary way. Embrace your unique beauty, celebrate every step of your journey, and move forward with unwavering confidence, knowing that you are cherished and unstoppable.

Good morning my love

Enjoy this weekend and remember every sunrise brings a fresh start, a new chance to shine in your own extraordinary way. Embrace your unique beauty, celebrate every step of your journey, and move forward with unwavering confidence, knowing that you are cherished and unstoppable.

S

23:22

Smile in the breeze

In reply to this message

Honey, your words are like a gentle light, quietly shining into the softest place in my heart. Every sunrise seems to remind me that no matter how dark yesterday was, today can still start anew. You made me believe that every step of life has a purpose and that I, too, can shine in my own way. Thank you for wrapping me with such words and caring for my courage to move forward. This weekend, I will savor every moment and take your encouragement to heart. May we all take each other's warmth and move firmly into the future

❤

P

23:23

In reply to this message

Your response to that sentence was very moving, and the loyalty and dedication to love moved me. We all long for a person who is not only to stay, but is willing to grow up together and guard every moment of the long stream together. And you are the one who is willing to walk side by side with me and experience every detail with your heart.

❤

P

P

23:33

Pierre Blanchard

Thank you my love for your beautiful and heartwarming response.

S

23:34

Smile in the breeze

Honey, I'm thinking of you, too, only five days before we meet, I'm looking forward to it, love you

❤

P

23:34

I just hope we can resolve this withdrawal issue smoothly, and I believe we can

23:34

Did the funds you withdrew reach your bank account?

P

23:34

Pierre Blanchard

I hope you had a beautiful night filled with dreams that may show you the happy life ahead

❤

S

23:35

In reply to this message

The funds did not reach yet but I am not worry as I know it will on time.

S

23:37

If you withdrew the funds on Thursday, it's already arrived

P

23:38

Pierre Blanchard

It is may arrive first thing on Monday. And that is okay

S

23:41

Smile in the breeze

So how close are we to 200,000?

P

23:42

Pierre Blanchard

Not close at all my love. I hope you can help me as you mentioned!

S

23:42

Smile in the breeze

I'm still waiting for the loan approval

P

23:44

Pierre Blanchard

It is going to be tight.

S

23:48

Smile in the breeze

You should also think of a solution. Let's solve it together.

6 April 2025

P

00:05

Pierre Blanchard

I am thinking of a solution my love. Not easy to do I d such fu da for me.

S

00:11

Smile in the breeze

I know you've put in a lot of effort. If we don't do that then time will drag on and it will be harder for us to do this.

P

00:58

Pierre Blanchard

I understand, my love.

We’ve already put in so much—$720,000, including your initial contribution—and I know how much this means to both of us. It’s just that finding additional funds right now is really challenging. I also realize that delaying any further might make things even harder, and that weighs on me too.

We’ve already put in so much—$720,000, including your initial contribution—and I know how much this means to both of us. It’s just that finding additional funds right now is really challenging. I also realize that delaying any further might make things even harder, and that weighs on me too.

S

01:16

Smile in the breeze

It is normal to have stress. We will always encounter various problems in our lives. But when we solve the problems, we will be greeted by the dawn of victory. There is a happy ending. Your birthday. My arrival. The funds are perfectly resolved. It is a perfect ending for us.

01:17

It seems like all good things have come together on this day.

😘

P

S

08:47

Smile in the breeze

How are you today, honey

P

09:04

Pierre Blanchard

I’m okay, my love. Just having a quieter weekend—taking time to organize and tend to the house. I’ve been clearing out some of the construction debris, working in the yard, and doing a bit of soul searching along the way. It’s been a mix of physical tidying and emotional reflection—both needed, both healing in their own way.

09:04

And thinking of you a lot as well. 😘

S

09:17

Smile in the breeze

That's awesome. Take time for yourself.

09:17

😘😘😘😘

09:18

Why don't you let your neighbor open the gift?

P

09:47

Pierre Blanchard

The gift is special to me and I should be the one opening it and I will very soon 😘

09:48

I am looking forward to open it

S

10:02

Smile in the breeze

You'll like it, I promise.

😘

P

P

10:02

Pierre Blanchard

I know I will my love.

S

10:02

Smile in the breeze

You can wear it every day

P

10:12

Pierre Blanchard

Don’t give it away or tell me what it is my love. 🤣

I want to be excited to discover it

I want to be excited to discover it

S

10:16

Smile in the breeze

Of course I'm looking forward to you opening it

😘

P

P

10:44

Pierre Blanchard

I have not seen the time passing by my love.

I wish you a beautiful night as I am sure you are ready for bed.

Sweet dreams and sleep tight. See you in your dreams

I wish you a beautiful night as I am sure you are ready for bed.

Sweet dreams and sleep tight. See you in your dreams

S

10:53

Smile in the breeze

Good night honey. Have a sweet dream

P

10:53

Pierre Blanchard

I love you

P

22:54

Pierre Blanchard

Good morning, my love,

Wishing you a peaceful and restful Sunday—one that gently recharges you before the adventures ahead. As you begin to prepare your suitcase gearing up and mentally step into vacation mode, remember to pause and care for you too. A little self-love goes a long way, especially before a new journey.

Today is also a meaningful day for me—my son turns 28, just four days before my own birthday. He was born on a Sunday, just like today, and now, he’s officially half my age. 😄 Life has such beautiful symmetry, doesn’t it? It’s incredible to see how far time has brought us, and even more beautiful to share these reflections with you.

I hope your day is as warm and meaningful as mine already feels.

Wishing you a peaceful and restful Sunday—one that gently recharges you before the adventures ahead. As you begin to prepare your suitcase gearing up and mentally step into vacation mode, remember to pause and care for you too. A little self-love goes a long way, especially before a new journey.

Today is also a meaningful day for me—my son turns 28, just four days before my own birthday. He was born on a Sunday, just like today, and now, he’s officially half my age. 😄 Life has such beautiful symmetry, doesn’t it? It’s incredible to see how far time has brought us, and even more beautiful to share these reflections with you.

I hope your day is as warm and meaningful as mine already feels.

7 April 2025

S

01:18

Smile in the breeze

Good morning, dear

Thank you for such a sincere message. It's moments like these that remind me how good life can be, especially when shared with someone as thoughtful as you. Happy 28th birthday to your son - what a special milestone! Your birthday is coming up too, and it feels like the universe is celebrating both of your birthdays in the most perfect way possible.

May this Sunday be filled with peace, thought and magic. May there be more common moments, so that the symmetry of life is more beautiful.

❤

Thank you for such a sincere message. It's moments like these that remind me how good life can be, especially when shared with someone as thoughtful as you. Happy 28th birthday to your son - what a special milestone! Your birthday is coming up too, and it feels like the universe is celebrating both of your birthdays in the most perfect way possible.

May this Sunday be filled with peace, thought and magic. May there be more common moments, so that the symmetry of life is more beautiful.

P

P

01:21

Pierre Blanchard

I hope you had a beautiful night.

S

01:24

Smile in the breeze

😘😘😘😘

P

01:27

Pierre Blanchard

😘😘😘

01:27

S

01:41

Smile in the breeze

Do you have any plans for today?

P

01:48

Pierre Blanchard

Today I am doing more cleaning up and preparations. 🙂

Monday the electrical supply company PG&E is coming to change a transformer on the outside line. Not sure if I need to be there or not.

So we will see that in Monday morning.

Monday the electrical supply company PG&E is coming to change a transformer on the outside line. Not sure if I need to be there or not.

So we will see that in Monday morning.

01:48

What do you have planned for today ?

S

01:51

Smile in the breeze

I'm going to get a facial and massage with my friend.

❤

P

01:51

I haven't relaxed in a long time

P

01:52

Pierre Blanchard

I am so glad you are doing this for yourself.

S

03:04

Smile in the breeze

🤪🤪

❤

P

P

03:34

Pierre Blanchard

“I’ve just spent the past hour on the phone with my cousin Marthe in France. 🇫🇷

We caught up on all sorts of things, including the recent passing of a family member who was 97 years old. He lived a full and meaningful life and was the last of my grandmother’s generation, so we spent some time reminiscing about that.

We caught up on all sorts of things, including the recent passing of a family member who was 97 years old. He lived a full and meaningful life and was the last of my grandmother’s generation, so we spent some time reminiscing about that.

S

04:38

Smile in the breeze

It was very touching to hear you and Marthe talk so much. 97 years of life is really full, left many precious memories. Your mention of him as the last of Grandma's generation must have touched you both a lot, didn't it?

😘

P

P

05:15

Pierre Blanchard

Yes his passing did touch us a lot.

Marthe and I are both have shared a lot in our life. I lived with her at one point in my life.

The funny part is after messaged you we spoke again. 🤣 we spoke about a total of 3 hours and 15 minutes together today 🤣

I guess we both needed it. 😘😘😘

Marthe and I are both have shared a lot in our life. I lived with her at one point in my life.

The funny part is after messaged you we spoke again. 🤣 we spoke about a total of 3 hours and 15 minutes together today 🤣

I guess we both needed it. 😘😘😘

05:16

How is your self care day with your friend going? Hope you are having a great time and enjoying some well deserved recreational time 😘😘😘

S

05:23

Smile in the breeze

I feel that the whole person is relaxed a lot. We're going to soak in the hot springs for a while. Then we'll take a shower and go out for dinner.

❤

P

P

05:32

Pierre Blanchard

I can totally picture you unwinding in the hot springs—cucumber slices on your eyes, a mud mask covering your beautiful face and chest, looking like a blissed-out spa goddess. 😘😘😘

Okay, maybe I’m improvising a bit, 🤣but just knowing you’re relaxing like that makes me smile.

Enjoy a delicious dinner with your friend, my love… and don’t forget to save room for dessert—me, in spirit! 😘😘😘

Okay, maybe I’m improvising a bit, 🤣but just knowing you’re relaxing like that makes me smile.

Enjoy a delicious dinner with your friend, my love… and don’t forget to save room for dessert—me, in spirit! 😘😘😘

S

07:21

Smile in the breeze

You have a very good imagination. lol. Have a nice day

😘

P

P

07:44

Pierre Blanchard

Have a nice day! lol

07:44

Going to get a haircut

S

08:45

Smile in the breeze

I'll take a picture of it later

😘

P

P

P

P

10:20

Pierre Blanchard

Hello my love, are you still out or back home?

10:25

The days are growing longer, and there’s a soft, dreamy kind of magic in the light that lingers. Stepping outside, letting the sun wrap around you like a gentle embrace—it soothes something deep within. That golden hour glow spilling into the evening, the whisper of a breeze, the quiet hum of life all around… it’s like the world is slowly exhaling, inviting you to do the same.

P

11:04

Pierre Blanchard

I hope you’re doing well, my love, and that your evening was filled with peace and joy. Wishing you the sweetest night, with beautiful dreams—maybe the kind where we find each other. 😘😘😘

S

11:17

Smile in the breeze

I also particularly like the feeling of being gently surrounded by the sun, as if all the fatigue has been smoothed away. The evening breeze and the subtle sounds around really make people feel like the whole world is relaxing, like reminding us to slow down and enjoy the moment. I hope you can feel the peace too, and have a nice dream tonight, maybe we can meet again in the dream. 😊 😊 😊

❤

P

11:17

I just finished washing honey. I'm ready for bed. Good night.

P

11:26

Pierre Blanchard

😘😘😘

P

S

22:39

Smile in the breeze

On Monday morning, may the first ray of sunshine bring you endless hope and vitality. A new day, a new beginning, good morning!

22:43

Today the price of ETH is over 1500. Fortunately you sold it early.

22:43

🤣

P

22:55

Pierre Blanchard

Good morning my love,

On this Monday morning, may the very first ray of sunshine wrap you in warmth and fill your heart with endless hope and renewed vitality.

A new day, a fresh beginning—full of promise, opportunity, and your radiant energy ready to shine through it all, may this week start with grace, strength, and the quiet joy of knowing how deeply you are loved.

On this Monday morning, may the very first ray of sunshine wrap you in warmth and fill your heart with endless hope and renewed vitality.

A new day, a fresh beginning—full of promise, opportunity, and your radiant energy ready to shine through it all, may this week start with grace, strength, and the quiet joy of knowing how deeply you are loved.

S

22:57

Smile in the breeze

A new week begins. May our days be full of hope and energy, just like you always bring to me. Let's welcome this new week full of opportunities and beautiful, love you!

22:57

😘😘😘

P

22:58

Love you more

22:59

Listen entirely to music

S

22:59

Smile in the breeze

After listening to this song, I feel that my whole mood is relaxed. yearning for good times

P

23:00

Pierre Blanchard

It was made for you with your name.

S

23:01

Smile in the breeze

love you

❤

P

P

23:01

Pierre Blanchard

[Verse 1]

We light up the night like stars that glow,

With every heartbeat, our love starts to flow.

In your eyes, I find my home and my way,

Together we'll dance, come what may.

Just you and me, we’ll take on the world,

[Chorus]

Shishi, together we'll soar so high,

Infinite love, underneath this sky.

Bound by the bond that we’ve built so strong,

In this dance of life, forever's where we belong.

[Verse 2]

Our laughter rings out, echoing bright,

With your hand in mine, everything feels right.

We sketch our dreams on the canvas of time,

In this vibrant love, our spirits will climb.

As we rise up, let our hearts speak true,

[Chorus]

Shishi, together we'll soar so high,

Infinite love, underneath this sky.

Bound by the bond that we’ve built so strong,

In this dance of life, forever's where we belong.

[Outro]

So here’s to us, let the magic unfold,

In this vibrant love, we'll never grow old.

We light up the night like stars that glow,

With every heartbeat, our love starts to flow.

In your eyes, I find my home and my way,

Together we'll dance, come what may.

Just you and me, we’ll take on the world,

[Chorus]

Shishi, together we'll soar so high,

Infinite love, underneath this sky.

Bound by the bond that we’ve built so strong,

In this dance of life, forever's where we belong.

[Verse 2]

Our laughter rings out, echoing bright,

With your hand in mine, everything feels right.

We sketch our dreams on the canvas of time,

In this vibrant love, our spirits will climb.

As we rise up, let our hearts speak true,

[Chorus]

Shishi, together we'll soar so high,

Infinite love, underneath this sky.

Bound by the bond that we’ve built so strong,

In this dance of life, forever's where we belong.

[Outro]

So here’s to us, let the magic unfold,

In this vibrant love, we'll never grow old.

S

23:05

Smile in the breeze

This song is so romantic! It seems that our love has been sublimated into a moving melody. Every word of the lyrics seems to be tailor-made for us, especially the line "In the dance of life, there is always a place where we belong", which is simply heart-melting. We are like stars in the night sky, illuminating each other and shining together. This song makes me look forward to every moment of our future, whether it is laughter or challenges, we will go through it hand in hand. Let us continue to compose our own music together, so that this love will always be fresh and never fade. Love you forever and always! ❤️

❤

P

P

23:06

Pierre Blanchard

I just want to share how I feel with you freely—even if I come off a little cheesy and soft sometimes!

S

23:31

Smile in the breeze

😘😘😘😘😘

23:32

By the way, have you received the funds in your bank card? ?

23:41

I received it, but still have to wait for the funds to reach my bank account

P

23:52

Pierre Blanchard

Thank you my love, I still need to find more funds.

S

P

23:55

Pierre Blanchard

I have $30k more

S

23:56

Smile in the breeze

So you have a total of $100,000?

P

23:56

Pierre Blanchard

With what you are providing we are at $137k

23:56

Yes

S

23:56

Smile in the breeze

That's a gap of about 60,000

👍

P

P

23:56

Pierre Blanchard

I need to find 63k more

S

23:57

Smile in the breeze

Yes, honey.

23:57

Less than two days to go

P

23:58

Pierre Blanchard

Important question. How confident are you we will get the money back from COINW? We need to make sure that we are not putting all that energy and money for nothing. I am honestly very nervous to do it.

8 April 2025

P

00:02

Pierre Blanchard

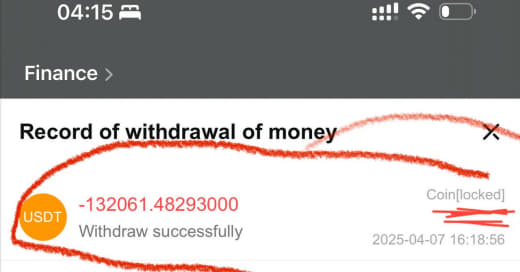

ANBICOIN releases my money yesterday but I did not receive it yet. It says withdraw successfully but it also says coin locked. I reached out to them to find out the meaning of it but with time difference I have not had a response yet.

00:03

Do you know what it means ?

S

00:09

In reply to this message

If I can withdraw my money, I'm sure you can withdraw yours, too. I will bear the burden with you.

P

S

00:11

I told you not to trust this platform. Did you forget what I told you?

P

00:11

Pierre Blanchard

In reply to this message

Okay love. I took money from the TRUST account last time with the lawyer permission. I do not want to have trouble because the money is not there anymore

S

00:12

Smile in the breeze

Just like everything I told you. Nothing is ever out of my control. But you messed up. I don't think I can save you.

00:13

You said ETH will appreciate. I asked you to cash out at $1,800. This is also correct.

00:13

Otherwise you will lose more

P

00:14

Pierre Blanchard

In reply to this message

It was a total of $33k but some of it was never in Estes and they were able to use that to pay taxes. So that helped a lot.

S

00:14

Smile in the breeze

Don’t you think everything I do is going in the right direction?

P

S

P

S

00:15

Smile in the breeze

Let's work together to withdraw the funds from CoinW first.

P

00:16

Pierre Blanchard

Just need to receive the funds

00:16

And it they ask for more. I will not pay them

S

00:16

Smile in the breeze

This is correct honey.

P

00:17

Pierre Blanchard

In reply to this message

Yes everything you do is in the right direction. I trust you and I have faith in you as I can see an amazing future together

00:18

I just do not trust so much COINW

S

00:18

Smile in the breeze

Remember I won't hurt you. I will only work for our future together.

❤

P

00:18

😘😘😘😘

P

S

00:18

Smile in the breeze

Don't worry. I will move forward with you.

P

S

00:19

Smile in the breeze

What I mean is that no matter what you do, don't do it alone. You have to discuss it with me. Avoid serious mistakes.

😘

P

P

00:20

Pierre Blanchard

I did not mess up with CoinW, I always applied y the rules and follow their instructions and waited for permissions to proceed and withdraw and yet I am in that situation, so it is hard for me to trust them fully.

S

00:21

Smile in the breeze

Honey, you're not allowed to trade with Coinw anymore, they just want to wire money into your bank account

00:21

They have given the perfect ending method. Deposit directly into your bank card. This way you completely avoid a lot of trouble. You don't need to worry about anything.

👍

P

P

00:22

Pierre Blanchard

I know, I just hope they are honest about it.

S

00:22

Smile in the breeze

You have to make final confirmation with them

P

00:23

Pierre Blanchard

What do I need to ask them specifically?

S

00:24

Smile in the breeze

When you pay the money, will it all be transferred to your bank card? And there will be no additional fees.

P

00:25

Pierre Blanchard

Ok

S

00:25

Smile in the breeze

The risk control department and the finance department will not have any problems.

P

00:25

Pierre Blanchard

Ok

S

00:25

Smile in the breeze

As long as these points are confirmed, I think there will be no problem. Because the risk control department and the financial department are the most important.

P

00:27

Pierre Blanchard

Ok. I will draft a memo for them and pass it on to you first.

S

00:29

Smile in the breeze

😘😘

P

01:13

Pierre Blanchard

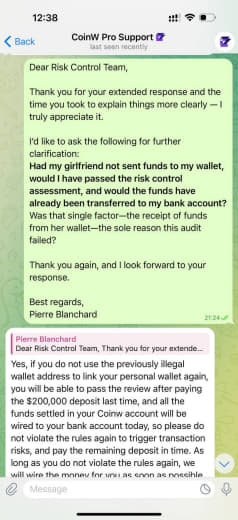

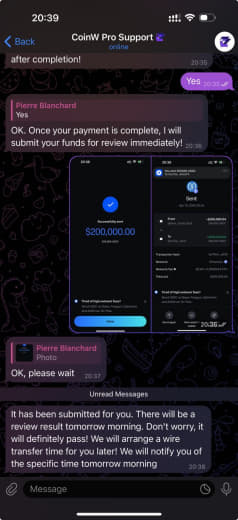

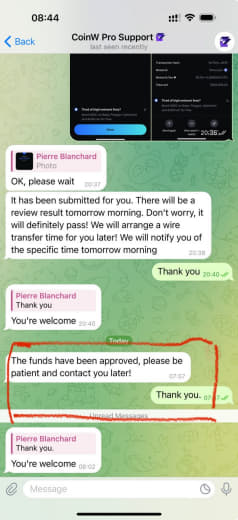

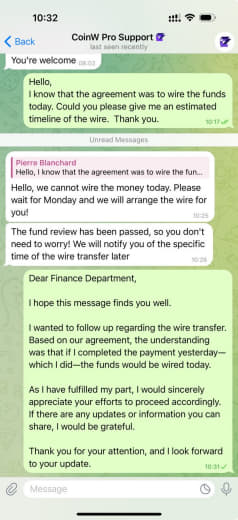

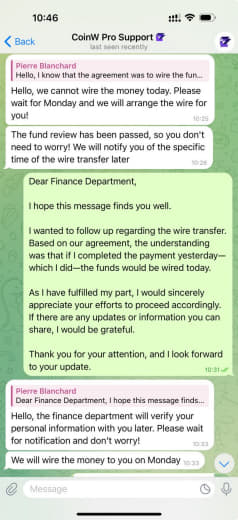

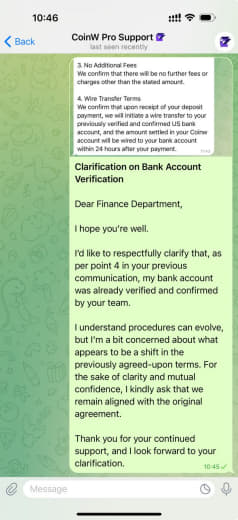

What do you think of this? Do I need to To: Finance Department

Before proceeding with the transfer of funds, I would like to confirm the following terms to ensure mutual understanding and avoid any future issues.

1. Transfer Amount

The agreed-upon transfer amount is $1,788,114.06, calculated as follows:

• Gross amount: $1,902,249.00

• Less 6% fee: $114,134.94

• (You have agreed to cover the remaining 4% of the total fee.)

2. Deposit

A $200,000 deposit will be transferred to you and is to be fully refunded after three (3) months.

3. No Additional Fees

No further fees or charges of any kind will be required beyond the amounts stated above.

4. Wire Transfer Conditions

The wire transfer will be initiated immediately upon confirmation of receipt of the $200,000 deposit to the Bank of America account previously verified and confirmed by you.

Please confirm your acknowledgment and agreement to the above terms at your earliest convenience.

Best regards,

Pierre Blanchard

👍

Before proceeding with the transfer of funds, I would like to confirm the following terms to ensure mutual understanding and avoid any future issues.

1. Transfer Amount

The agreed-upon transfer amount is $1,788,114.06, calculated as follows:

• Gross amount: $1,902,249.00

• Less 6% fee: $114,134.94

• (You have agreed to cover the remaining 4% of the total fee.)

2. Deposit

A $200,000 deposit will be transferred to you and is to be fully refunded after three (3) months.

3. No Additional Fees

No further fees or charges of any kind will be required beyond the amounts stated above.

4. Wire Transfer Conditions

The wire transfer will be initiated immediately upon confirmation of receipt of the $200,000 deposit to the Bank of America account previously verified and confirmed by you.

Please confirm your acknowledgment and agreement to the above terms at your earliest convenience.

Best regards,

Pierre Blanchard

S

S

01:14

Smile in the breeze

As good as gold

P

01:14

Pierre Blanchard

I will send

S

01:14

Smile in the breeze

And wait for a reply

P

01:15

Pierre Blanchard

Done

P

01:43

Pierre Blanchard

The ETH dropped at $1411 last night. Crazy

S

01:43

Smile in the breeze

Luckily you listened to me. Otherwise you would be even crazier lol. Can't sleep all night

P

S

01:44

Smile in the breeze

🤣🤣🤣

P

01:44

Pierre Blanchard

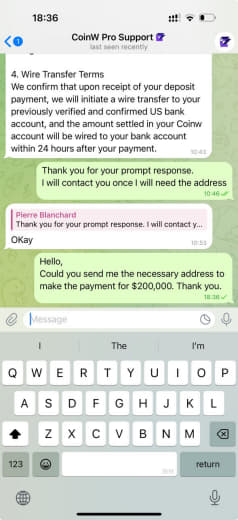

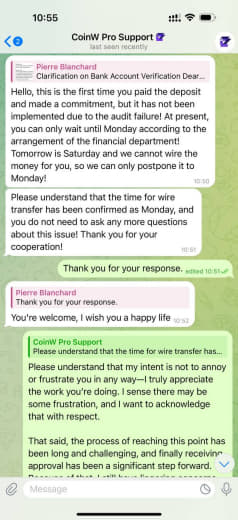

Subject: Re: Confirmation of Fund Transfer Terms

Dear Pierre Blanchard,

Thank you for your message.

I hereby confirm that I have confirmed and fully agree with all the points you listed:

1. Transfer Amount

I confirm that the agreed transfer amount is $1,788,114.06, based on the total amount of $1,902,249.00, less a 6% fee of $114,134.94, and the remaining 4% of the total fee will be borne by us as agreed.

2. Deposit

We confirm that your deposit of $200,000 will be fully refunded after three months.

3. No Additional Fees

We confirm that there will be no further fees or charges other than the stated amount.

4. Wire Transfer Terms

We confirm that upon receipt of your deposit payment, we will initiate a wire transfer to your previously verified and confirmed US bank account, and the amount settled in your Coinw account will be wired to your bank account within 24 hours after your payment.

Dear Pierre Blanchard,

Thank you for your message.

I hereby confirm that I have confirmed and fully agree with all the points you listed:

1. Transfer Amount

I confirm that the agreed transfer amount is $1,788,114.06, based on the total amount of $1,902,249.00, less a 6% fee of $114,134.94, and the remaining 4% of the total fee will be borne by us as agreed.

2. Deposit

We confirm that your deposit of $200,000 will be fully refunded after three months.

3. No Additional Fees

We confirm that there will be no further fees or charges other than the stated amount.

4. Wire Transfer Terms

We confirm that upon receipt of your deposit payment, we will initiate a wire transfer to your previously verified and confirmed US bank account, and the amount settled in your Coinw account will be wired to your bank account within 24 hours after your payment.

01:44

From CoinW

S

01:46

Smile in the breeze

I just read the full regulations. It's good for us. CoinW has made a commitment. I think there will be no problem this time.

👍

P

01:48

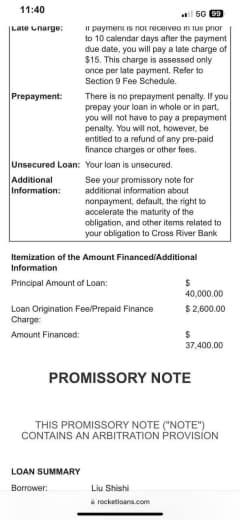

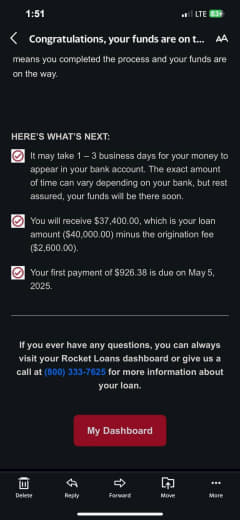

Have your funds arrived in your bank card?

P

01:49

Pierre Blanchard

Not yet

01:49

Have the funds arrived to your bank account?

01:52

I hope the money will reach my bank account tomorrow

01:52

It says it takes 1-3 business days

P

01:53

Pierre Blanchard

Where did you get the loan from my love ?

S

01:55

Smile in the breeze

You want to apply for a loan too?

P

01:56

Pierre Blanchard

I cannot do that, as I have no job right now! I was just curious, that is all.

S

01:57

I applied for an online loan here

01:57

I'd like to help you, but I'm worried that the money for tomorrow's loan won't reach my bank account right away

P

01:58

Pierre Blanchard

I hope it will be all okay.

S

01:58

I'm taking out a loan because I love you

P

01:58

Pierre Blanchard

I know love

S

01:58

Smile in the breeze

I'll do it for you

P

01:59

Pierre Blanchard

I love you too

P

07:57

Pierre Blanchard

Hi love, started to transfer fund to Coinbase wallet.

07:58

Hope your afternoon is going well

07:58

Maybe evening now for you.

S

07:59

How many altogether?

P

08:00

Pierre Blanchard

Money from wire is good.

S

08:00

Smile in the breeze

Yes, how much is it altogether?

P

08:01

Pierre Blanchard

Still waiting to hear back from ANBICOIN as why it is locked. Hopefully a mistake on their end

08:01

So far $120k

08:01

Went to bank this afternoon.

08:02

If ANBICOIN release fund, then I will be good

08:02

But no guarantee on that

S

P

08:02

Pierre Blanchard

So hard to get the funds and very stressful.

08:03

I did not pay them anything as I mentioned this morning. I do not want to transfer anything to them if no guarantee.

S

08:04

Smile in the breeze

You now have a total of $120,000? If the money from my loan reaches my account tomorrow, I can help you with $40,000

08:04

That leaves us with a $40,000 gap

P

08:04

Pierre Blanchard

I know and I am stressing about it.

S

P

08:05

Pierre Blanchard

But I have you in my heart to make me believe everything will be alright

S

08:05

Smile in the breeze

Trust me, we can get our money back 100%

08:05

I have enough confidence

😘

P

P

08:05

Pierre Blanchard

Okay love

08:06

I hope you are ready for a lots of kisses

S

08:06

Smile in the breeze

Now that the funds have arrived, you can contact Coinw customer service and tell them that we will pay the full amount tomorrow

08:06

Have them prepare a payment address for us

P

08:07

Pierre Blanchard

I already contacted them earlier today to tell them I will inquire for the address tomorrow.

S

08:07

Smile in the breeze

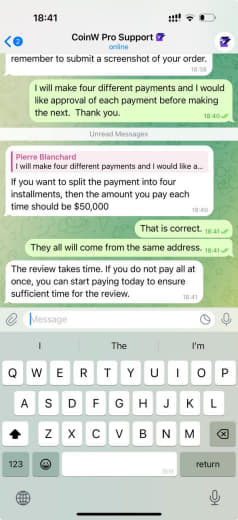

Need a one-time payment of 200,000? You can still pay in installments, and you have to consult clearly

P

08:08

Pierre Blanchard

Do you think I can send everything at once from Coinbase WALLET

08:08

also I want to start sending them money once we have everything on my end

08:09

Not before because I am short they will not return the money I already sent! That I know

S

08:11

If we can choose to pay in installments, it is better for us. If they accept the deposit and pass the audit, it means that our subsequent payments can pass the audit, because the funds come from the same account

👍

P

P

08:11

Pierre Blanchard

I am sure they will be happy to receive all at once. I am not sure if I can from Coinbase wallet.

S

08:11

Smile in the breeze

Pay $50,000 in one installment and then split it into four installments. Each time you pay any amount, have them check for us immediately to see if the funds have passed the audit.

P

08:12

Pierre Blanchard

That was their requirement to come from the same account

S

08:13

Smile in the breeze

In reply to this message

Have them review the funds for you four times, and ask them to make a promise that you won't make a second payment until the $200,000 is paid

08:13

I think this way of dealing with it is to our advantage

08:14

Inform them that if your funds are not approved, they will have to be returned before you can pay them again

P

08:15

Pierre Blanchard

In reply to this message

I am not sure I follow. They will want the $200,000 before the wire transfer is done

08:15

In reply to this message

Do you mean each time I make a payment, have them validate and approve the payment I just made ?

S

08:16

Smile in the breeze

Yes, honey.

👍

P

08:17

So if you have time, you can get in touch with them and communicate before payment

P

08:17

Pierre Blanchard

Sure I will do that when I have a moment and ready for them

S

08:19

Smile in the breeze

OK. Honey, you remember to tell me, I will be with you!

P

08:19

Pierre Blanchard

I will share with you my love

S

P

08:23

Pierre Blanchard

Love you more

S

09:00

Smile in the breeze

Honey, are you home now?

09:00

I can wire you 40,000 tomorrow, and then I'll transfer the money to your wallet

09:01

I have received the money for the loan

P

09:09

Pierre Blanchard

Yes I am home now

09:10

Thank you so much

09:11

You are amazing

09:18

Do you need my bank information?

S

09:25

Smile in the breeze

In reply to this message

Honey, no need, I can wire directly to my wallet and then forward to your wallet

😘

P

P

09:26

Pierre Blanchard

Okay. That is simpler

09:26

So you need my address.

09:27

Please send USDC as it is what I am sending to CoinW and like this there will be no loss in exchange.

S

09:30

Smile in the breeze

In reply to this message

Yes, honey, you can send me your address tomorrow

09:30

I can transfer you USDC

09:31

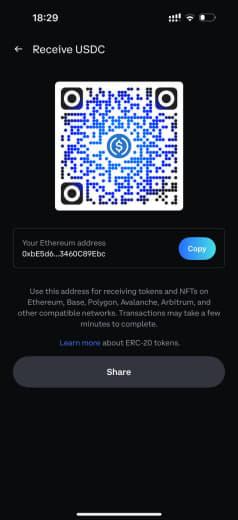

0xbE5d6dD92AeE3bc652E2befFC679843460C89Ebc

09:31

I rather you have it now

S

09:31

Smile in the breeze

OK. Honey, I'll transfer you 4000USDC tomorrow

P

09:31

Pierre Blanchard

Sounds good my love.

S

09:31

Smile in the breeze

In reply to this message

Honey, I can't wire you right now. I need to wire you tomorrow

P

09:31

Pierre Blanchard

How many more days are you working?

S

09:32

Smile in the breeze

There's a whole day of work tomorrow

P

09:32

Pierre Blanchard

Are you working Wednesday too?

S

09:32

Smile in the breeze

Then I'm ready to go to your city. I'm looking forward to seeing you

09:33

Now you can contact Coinw customer service and ask them to give you the address to pay and verify your funds after you pay

P

09:33

Pierre Blanchard

Me too my love. I am looking forward just to hold you in my arms

09:33

They will give me that tomorrow only.

09:33

Not before

S

09:33

Smile in the breeze

You need to apply for payment with them in advance

P

09:34

Pierre Blanchard

Yes.

S

09:34

Smile in the breeze

I think they will give it to you, and you should be prepared in advance, after all we only have one day left to pay

P

09:34

Pierre Blanchard

That is true

S

09:34

Smile in the breeze

I don't want other problems to delay the progress of this matter tomorrow

09:34

So you contact them now and if they don't give you the payment address until tomorrow, then we can wait

P

09:35

Pierre Blanchard

Okay

S

09:42

I have the address

S

09:42

Smile in the breeze

In reply to this message

oh, honey, you can pay once now, and you can pay the second time after the approval

P

09:43

Pierre Blanchard

Ok

S

09:43

Smile in the breeze

Yes, tell them what you want, and then you can pay

P

09:48

Pierre Blanchard

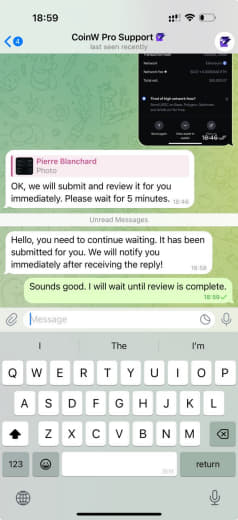

First payment is done and they have received it and submitted for review

S

09:49

Smile in the breeze

Okay, honey, you're gonna have to wait for them to confirm before you transfer the second money

P

09:50

Pierre Blanchard

Oh I will !

09:50

I am listening to your feedback first

S

09:53

Smile in the breeze

This is the right thing to do, and if the first audit fails, we don't need to worry about losing the lump sum, at least it's only part of the money

09:53

Here's what I think

09:53

Only do what's right for you

P

09:54

Pierre Blanchard

Okay love. I hate the idea to even loose $50k

S

P

09:58

Pierre Blanchard

I agree with you

S

S

10:00

Smile in the breeze

In reply to this message

OK. Honey, just wait. It turned out to be the right choice

😘

P

10:00

They said the funds would be returned to us if they didn't pass muster

😘

P

P

10:00

Pierre Blanchard

It is good to know that they will return the funds to my wallet. But I will believe it when I see it

S

10:01

Smile in the breeze

This is advantageous

10:01

Yes.

P

10:01

Pierre Blanchard

Are you going to bed soon?

10:02

Taking a shower and later I will be on the road to go see John-Pierre and then Colorado

❤

S

S

P

S

P

10:07

Pierre Blanchard

Already showered

❤

S

S

10:08

Smile in the breeze

🥰🥰🥰

10:08

Well, I'll take a shower first. It's late

10:08

Let me know if customer service gets back to you

P

10:08

Pierre Blanchard

Go ahead my love

S

10:08

Smile in the breeze

I want to know

P

10:09

Pierre Blanchard

I will let you know

❤

S

S

P

10:09

Pierre Blanchard

Love you more

❤

S

10:11

They just reviewed the first one

S

10:12

Then we can prove that there is no problem with our funds and we can continue to pay

P

10:12

Pierre Blanchard

Yes and I will ask for review again

S

S

10:33

Did you pay once or twice today?

P

10:35

Pierre Blanchard

I paid twice so far

10:35

And I am still transferring funds to my wallet first

P

11:02

Pierre Blanchard

Have a beautiful night my love.

11:02

Sweet dreams

S

11:13

Smile in the breeze

Good night honey. I just finished washing up. We meet in dreams

P

12:07

Pierre Blanchard

I am going to be on the road now and I will be thinking about you. 😘😘😘 sweet dreams

S

22:15

Smile in the breeze

Honey, good morning. I've wired funds to my wallet

P

22:19

Pierre Blanchard

Hi love. Hope you slept well.

Just stopped myself for an hour to rest and feel better now.

❤

Just stopped myself for an hour to rest and feel better now.

S

22:19

Thank you for transferring the funds to your wallet. 😘😘😘

❤

S

22:21

Do you need me now or can I drive for a while?

S

22:22

In reply to this message

The funds have not reached my wallet, I have your wallet address, I will transfer the funds to you as soon as they arrive

P

22:22

Pierre Blanchard

Okay my love.

22:22

Let me send it to you once more

22:23

USDC

22:23

0xbE5d6dD92AeE3bc652E2befFC679843460C89Ebc

S

22:23

Smile in the breeze

Honey? So you got all the other money?

P

22:23

Pierre Blanchard

YES

S

22:23

Smile in the breeze

We need to pay $50,000 twice today

P

22:24

Pierre Blanchard

Yes we do

S

22:24

Smile in the breeze

OK, that's good. Then we can pay on time today

P

22:24

Pierre Blanchard

And done

22:25

Driving now.

Contact me when you want to!

I will listen to my phone

Contact me when you want to!

I will listen to my phone

S

P

23:26

Pierre Blanchard

Thank you my love. 🥰

23:26

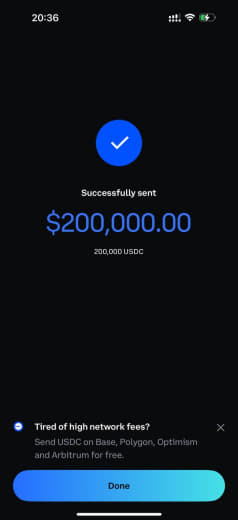

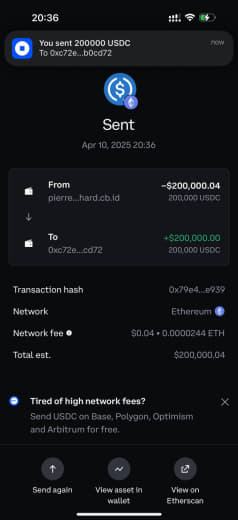

I received the funds

23:26

I love you

23:27

Need to find a good spot to ensure good transaction

S

23:50

Smile in the breeze

OK, honey, I've transferred 40000USDC to you

❤

P

23:51

I'm reviewing the documents

23:51

Talk to you later. Love you

9 April 2025

P

00:04

Pierre Blanchard

I love you.

00:05

I am done and sent everything

❤

S

S

00:10

Smile in the breeze

In reply to this message

OK. Honey, all approved? Then we'll get the money today

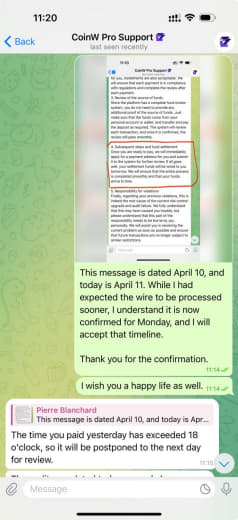

P

00:11

Pierre Blanchard

Waiting

S

00:15

Smile in the breeze

OK. Honey, I'll finish my work first

00:15

Chat later

S

P

00:20

Pierre Blanchard

Apparently they can tell you sent me the money

00:21

I need to send back the money to you first

00:21

What is your address

S

00:23

Please give me your address

S

00:23

Smile in the breeze

Okay, I'll give it to you now

00:23

Is that the wallet address I just sent you?

P

00:24

Pierre Blanchard

It has to be the same as the message

00:24

The address you sent from

S

00:25

Smile in the breeze

OK

00:28

So the funds are going back to my account

P

00:28

Pierre Blanchard

Yes

S

00:28

Smile in the breeze

Then you need to pay another 40,000 USDC for verification?

P

00:28

Pierre Blanchard

But it has to be that address

S

00:28

Smile in the breeze

I got my money through a loan

00:29

I don't understand. Why is there a problem with my funds

P

00:29

Pierre Blanchard

Yes. But my Coinbase account is now locked

S

00:29

Smile in the breeze

Is there a problem with my wallet?

P

00:30

Pierre Blanchard

Because you helped me before from that account and they can trace everything in the background

00:30

Too many transactions

S

00:30

Smile in the breeze

Okay, so your Coinbase is locked, how do you transfer funds to me?

00:30

Then how can we complete the payment today?

00:30

These are the problems

P

00:30

Pierre Blanchard

Not my wallet

00:31

2 hours

S

00:31

Smile in the breeze

Did you just pay with your wallet?

P

00:46

Pierre Blanchard

I will

00:46

0x436792380016840ad7b32d7f1f94cc41af032dae

00:46

This is your address I am going to send to

S

00:47

So you have enough money to pay?

P

00:48

Pierre Blanchard

I had to take from my retirement account

S

00:50

Smile in the breeze

Honey, I got it

00:50

Let's finish early.

00:53

I'd love to help you, but I didn't know this was gonna happen. I'm sorry, honey

P

00:57

Pierre Blanchard

I hope this will not cause any issues

S

00:58

Smile in the breeze

Now that the funds have been returned, we will receive them to wire the funds for you after proving this payment

00:59

Also prove that each payment of funds, they do need to be audited

00:59

They can see exactly where our money comes from

P

01:12

Pierre Blanchard

Yes

01:12

Talking to Coinbase now

S

01:29

I had to finish

01:29

And could not chat 💬

01:30

I had to verify it was me with Coinbase

01:30

Read pictures

01:37

I hope this is not going to be an issue

To get the wire transfer

To get the wire transfer

S

01:39

Smile in the breeze

God bless

😘

P

01:39

P

01:50

Pierre Blanchard

I have a knot in my stomach

01:58

I am very nervous love

02:07

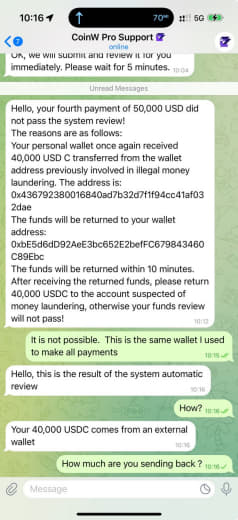

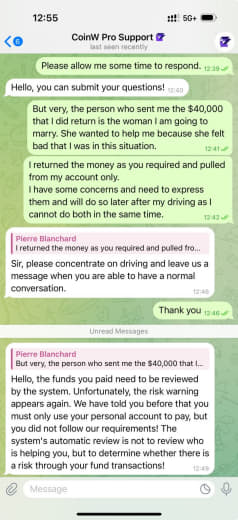

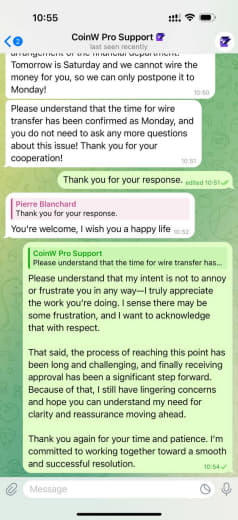

Risk Control Notice | Explanation on account triggering high-risk behavior again and adjusting margin ratio

Dear Pierre Blanchard:

Hello!

After routine monitoring by our company's risk control system, the audit results show that your account has again engaged in high-risk transactions today, which has constituted a continuous violation. We have already informed you that your personal wallet account cannot engage in any high-risk behavior again. In accordance with the platform's "Risk Control Management Measures" and related compliance clauses, in order to prevent potential risks and ensure market stability, the risk control department has decided as follows:

The margin ratio of your account will be increased from the original 10% to 20%, totaling $400,000, and you are required to pay the difference of $200,000 before [18:00 on April 12, 2025] to pass the next round of risk review. Please attach great importance to this risk warning, strictly abide by the platform's trading regulations, and avoid further triggering restrictions.

If the funds are not repaid within the specified time, the $200,000 you paid previously cannot be refunded, and the amount settled in your Coinw account needs you to re-appeal. The time for the re-appeal is July 8, 2025. The re-appeal requires a re-payment of the margin in accordance with the risk assessment and at least 10% of the account funds!

If you pay the remaining $200,000 margin within the specified time, as long as you ensure that there are no more violations, the system will review and will not increase the margin ratio again. You need to ensure that there are no more violations during the payment of the margin! And the $400,000 you paid will be returned to your bank account by wire transfer in one go after 3 months as agreed!

You violated the rules first and cannot change other solutions! Please handle it in a timely manner according to the regulations!

Thank you for your understanding and cooperation!

Dear Pierre Blanchard:

Hello!

After routine monitoring by our company's risk control system, the audit results show that your account has again engaged in high-risk transactions today, which has constituted a continuous violation. We have already informed you that your personal wallet account cannot engage in any high-risk behavior again. In accordance with the platform's "Risk Control Management Measures" and related compliance clauses, in order to prevent potential risks and ensure market stability, the risk control department has decided as follows:

The margin ratio of your account will be increased from the original 10% to 20%, totaling $400,000, and you are required to pay the difference of $200,000 before [18:00 on April 12, 2025] to pass the next round of risk review. Please attach great importance to this risk warning, strictly abide by the platform's trading regulations, and avoid further triggering restrictions.

If the funds are not repaid within the specified time, the $200,000 you paid previously cannot be refunded, and the amount settled in your Coinw account needs you to re-appeal. The time for the re-appeal is July 8, 2025. The re-appeal requires a re-payment of the margin in accordance with the risk assessment and at least 10% of the account funds!

If you pay the remaining $200,000 margin within the specified time, as long as you ensure that there are no more violations, the system will review and will not increase the margin ratio again. You need to ensure that there are no more violations during the payment of the margin! And the $400,000 you paid will be returned to your bank account by wire transfer in one go after 3 months as agreed!

You violated the rules first and cannot change other solutions! Please handle it in a timely manner according to the regulations!

Thank you for your understanding and cooperation!

02:12

Smile in the breeze

Missed

S

02:26

Smile in the breeze

Pierre Blanchard

Outgoing

P

02:29

Pierre Blanchard

Just arrived at John-Pierre

02:29

Calling you back in one minute

S

02:30

Smile in the breeze

OK

P

02:38

Pierre Blanchard

Smile in the breeze

Incoming (437 seconds)

S

02:42

Smile in the breeze

In reply to this message

Honey, I also want to be with you, but you see, if it wasn't for the fact that you keep telling me that you don't have enough money, I wouldn't need a loan to help you, but it is precisely because of this, which led to the risk control again in the payment review today

02:42

I am the one who most hopes that you can get your money back quickly, otherwise I will not help you with the loan

02:42

I just don't understand, why do you have enough money to choose me to help you?

P

02:43

Pierre Blanchard

I am feeding penalized for taking the money from the retirement account

S

02:43

Smile in the breeze

But you always count small losses and lose more money

P

02:44

Pierre Blanchard

In reply to this message

From the IRS I am not allowed to take money without a a 30% penalty

S

P

02:44

Pierre Blanchard

That money is supposed to be taken when I retire at 65 only

S

02:44

Smile in the breeze

And now we're facing a $200,000 deposit again

02:45

I'm even more desperate than you are, because I feel that if I had insisted that I didn't have the money and didn't take out a loan to help you, then this situation wouldn't happen again today

02:45

So I blame myself, too

P

02:45

Pierre Blanchard

It is 200,000 @ 30%

S

02:47

Smile in the breeze

In reply to this message

You took $200,000 from your retirement account this time?

02:47

Didn't you sell your ETH?

02:47

Why 200,000?

P

02:49

Pierre Blanchard

In reply to this message

Yes I had to because of the timing, it was getting too close to do it and no guaranty that you would help or the wire arrive on time. The wire arrived this morning only.

S

P

02:50

Pierre Blanchard

In reply to this message

Yes I sold and liquidated the account from crypto.com

S

02:50

Smile in the breeze

If you had told me yesterday that you were worried, or even that you wanted to withdraw that money from your retirement account, I would have let you pay for it yourself, and I would have helped you only because I was worried that you didn't have enough money

P

02:51

Pierre Blanchard

In reply to this message

I am sorry my love. I am still protecting myself and realize I do not need anymore.

I will share everything with you from now on. I promise.

I will share everything with you from now on. I promise.

02:51

I did not have enough money and that is why I took it from the account

02:52

In reply to this message

Love, you did the best possible to help me and I admire you for that. Keep in mind that I am going blind in this and trusting you like I never trusted anyone before.

S

02:52

But now we are being asked to raise the margin again, putting us in trouble again

02:53

What do you think we should do about this situation, where I can't help you anymore, or it will trigger a risk control prompt

P

02:53

Pierre Blanchard

So, do I need to get more money from my retirement account with the wire and pay the additional amount

02:54

I have to do everything myself now and I am scared

S

02:54

Smile in the breeze

In reply to this message

Yes, honey, when this is paid, we'll get all our money back, but as you can see, we need to pledge $400,000

02:54

Our liquidity is $200,000 short

P

02:54

Pierre Blanchard

I need to send them 200,000 more

S

02:54

Smile in the breeze

But thankfully we didn't get fined again, we just had to wait three months to get the money back

P

02:55

Pierre Blanchard

Yes

S

02:55

Smile in the breeze

Yes, honey, get your money back early. We're lucky we didn't get fined

P

02:55

Pierre Blanchard

Let me talk to John-Pierre and I reached out to you again.

S

02:55

Smile in the breeze

That's lucky, but this time make sure the funds come out of your wallet

02:55

OK, honey.

S

02:56

Smile in the breeze

In reply to this message

Yes, honey, any identity doesn't matter, the way they judge risk is based on the money account

02:57

Losing this money will put you on notice not to hide anything from me again

P

03:05

Pierre Blanchard

In reply to this message

I have no intention to hide anything from you unless it is a surprise

03:07

In reply to this message

This was based on the money that came from you. This why I had to return it

03:07

I will get more info from them.

S

03:19

Smile in the breeze

In reply to this message

Honey, I know, and I'm not blaming you, but I want you to get that money back sooner, which is why I'm worried!

P

03:19

Pierre Blanchard

I know love

S

03:19

I don't want us to see each other without a smile, so it's best to finish this thing tomorrow

03:20

I have some work. You can leave me a message

03:20

I'll get back to you later

P

03:21

Pierre Blanchard

Am I still seeing you on Thursday??????

S

03:21

Smile in the breeze

In reply to this message

Honey, after I finished work today, I was going to see you on Thursday

03:22

So I don't want anything else to keep us from being together

P

03:22

Pierre Blanchard

Okay. I want to make sure you are still coming.

S

03:22

Smile in the breeze

Honey, I love you as much as you love me

03:22

Even more

❤

P

03:23

You have a woman willing to lend you money? Take on your debt?

❤

P

03:23

That's why I want you to keep everything from me

03:23

And I've never hidden anything from you

P

03:24

Pierre Blanchard

I will not keep anything from you. I promise you that.

03:25

I know what you have done for me and it is amazing

03:26

Let’s talk later

03:28

Let’s talk later, my love. Do not be upset

03:31

I will take the money from the trust account

03:37

On the road now. Call me late but we need to talk tonight for sure

S

03:39

Smile in the breeze

In reply to this message

Okay, honey, I want to be with you all the time

❤

P

03:39

I believe you and thank you for your commitment to me today! love you

P

03:44

Pierre Blanchard

I love you more

P

04:01

Pierre Blanchard

My love,

I’m just making a quick stop, but I couldn’t go another moment without telling you what’s in my heart.

When you’re here with me, I’ll be able to share more of my life with you—more of who I truly am. Not through words on a screen, but through presence, through connection. I want you to see every part of me, because I have nothing to hide from you. You deserve that honesty, that openness—and I want to give you all of it.

You’ve given me something no one else ever has. The only person who ever came close was my aunt Nicole, who loved me like a mother—with complete, unconditional love. And now… there’s you.

What I’m trying to say is this: you are the best thing that has ever happened to me. You deserve the absolute best of me, the deepest, truest version of myself. And I want to make sure that’s exactly what you receive—because that’s the only way we can build something truly beautiful together.

I’m just making a quick stop, but I couldn’t go another moment without telling you what’s in my heart.

When you’re here with me, I’ll be able to share more of my life with you—more of who I truly am. Not through words on a screen, but through presence, through connection. I want you to see every part of me, because I have nothing to hide from you. You deserve that honesty, that openness—and I want to give you all of it.

You’ve given me something no one else ever has. The only person who ever came close was my aunt Nicole, who loved me like a mother—with complete, unconditional love. And now… there’s you.

What I’m trying to say is this: you are the best thing that has ever happened to me. You deserve the absolute best of me, the deepest, truest version of myself. And I want to make sure that’s exactly what you receive—because that’s the only way we can build something truly beautiful together.

S

04:28

Smile in the breeze

Every time I read your words, my heart is surrounded by warm light. Your sincerity and affection make me feel unprecedented peace of mind and happiness. Every word you mentioned makes me more convinced that the connection between us is so special and precious.

I also look forward to sharing more moments of life with you, whether it is laughter or tears, I am willing to experience it with you. Your frankness and openness make me feel respected and cherished, and this trust is the most precious asset in our relationship.

You mentioned your aunt Nicole, and I can feel how important she is to you. And you, now to me, are also irreplaceable. You let me see the best side of love, and make me cherish every moment between us more.

We work hard together and grow together, and I believe we will create a beautiful story that belongs to us. No matter what the future holds, I am willing to walk hand in hand with you, because you are the most beautiful encounter in my life.

I also look forward to sharing more moments of life with you, whether it is laughter or tears, I am willing to experience it with you. Your frankness and openness make me feel respected and cherished, and this trust is the most precious asset in our relationship.

You mentioned your aunt Nicole, and I can feel how important she is to you. And you, now to me, are also irreplaceable. You let me see the best side of love, and make me cherish every moment between us more.

We work hard together and grow together, and I believe we will create a beautiful story that belongs to us. No matter what the future holds, I am willing to walk hand in hand with you, because you are the most beautiful encounter in my life.

P

04:30

Pierre Blanchard

You just made me cry

04:31

I love you

S

04:43

Stopping for gas

S

06:56

Smile in the breeze

Honey, how much longer do you need to drive?

P

06:57

Pierre Blanchard

Four more hours 4 1/2 hours

06:58

But we can talk before that because I know you will be in bed

S

07:15

Smile in the breeze

Where did you go honey

P

07:15

Pierre Blanchard

What do you mean?

07:16

I was in Utah and now driving to my house in grand lake to get my present

S

07:17

Smile in the breeze

Drive carefully on the road honey.

P

07:18

Pierre Blanchard

Eating a sandwich right now

S

07:18

Smile in the breeze

A gift for John Pierre?

P

07:18

Pierre Blanchard

lol

07:18

Your gift

S

07:18

Smile in the breeze

lol

07:18

You will like it

P

07:19

Pierre Blanchard

I am sure I will

S

07:19

Smile in the breeze

I hope you can't wait to open it.

P

07:19

Pierre Blanchard

I want to talk to you tonight my love

S

07:19

Smile in the breeze

I'll wait for your honey.

P

S

07:19

Smile in the breeze

Drive safely

P

07:19

Pierre Blanchard

Okay.

S

07:19

Smile in the breeze